O que são Bots de Negociação com IA

Bots de negociação com IA são programas de software que utilizam inteligência artificial para automatizar processos de negociação em mercados financeiros. Esses bots usam algoritmos avançados e técnicas de aprendizado de máquina para analisar dados de mercado, identificar oportunidades de negociação e executar transações sem intervenção humana. Os bots de negociação com IA podem operar 24 horas por dia, permitindo que os traders aproveitem os movimentos do mercado a qualquer momento.

Como Funcionam os Bots de Negociação com IA

- Análise de Dados: Bots de IA processam grandes quantidades de dados de mercado para identificar padrões e tendências.

- Tomada de Decisão Algorítmica: Usando estratégias predefinidas, os bots tomam decisões de negociação com base na análise de dados.

- Execução Automatizada: Bots executam negociações automaticamente, garantindo respostas rápidas às mudanças do mercado.

- Aprendizado Contínuo: Alguns bots usam aprendizado de máquina para refinar suas estratégias com base no desempenho histórico.

Benefícios dos Bots de Negociação com IA

Bots de negociação com IA oferecem várias vantagens para traders que buscam aprimorar suas estratégias de negociação e melhorar a eficiência.

Principais Benefícios

- Operação 24/7: Bots de IA podem negociar continuamente sem pausas, maximizando as oportunidades de negociação.

- Velocidade e Eficiência: Bots podem processar dados e executar negociações mais rápido que traders humanos.

- Negociação Sem Emoções: Bots automatizados eliminam a tomada de decisão emocional, aderindo estritamente a algoritmos.

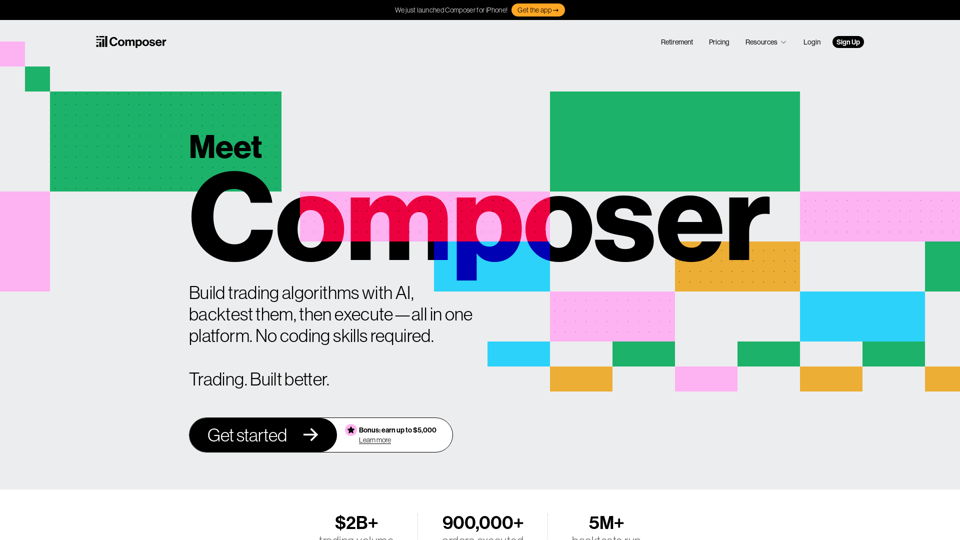

- Capacidades de Backtesting: Muitas plataformas permitem testar estratégias contra dados históricos para otimizar o desempenho.

- Gestão de Risco: Recursos como configurações de stop-loss e take-profit ajudam a gerenciar riscos de negociação de forma eficaz.

Como Usar Bots de Negociação com IA

Para usar eficazmente bots de negociação com IA, os traders devem considerar vários fatores e seguir as melhores práticas para maximizar seu potencial.

Passos para Implementar Bots de Negociação com IA

- Defina Objetivos de Negociação: Clarifique seus objetivos de investimento e tolerância ao risco.

- Selecione uma Plataforma Confiável: Escolha uma plataforma que suporte suas bolsas preferidas e ofereça medidas de segurança robustas.

- Personalize Estratégias: Ajuste os parâmetros do bot para alinhar com seu estilo de negociação e objetivos.

- Monitore o Desempenho: Revise regularmente o desempenho do bot e faça ajustes necessários.

- Implemente Gestão de Risco: Use recursos como ordens de stop-loss para mitigar perdas potenciais.

Considerações para Escolher um Bot

- Bolsas Suportadas: Certifique-se de que o bot integra-se com as bolsas que você utiliza.

- Interface do Usuário: Opte por uma plataforma com uma interface intuitiva para fácil navegação.

- Recursos de Segurança: Priorize bots com protocolos de segurança fortes, como autenticação de dois fatores.

- Estrutura de Custos: Entenda o modelo de preços, incluindo taxas de assinatura e transação.

Bots de negociação com IA podem ser uma ferramenta poderosa para traders que buscam automatizar e otimizar suas estratégias de negociação. Ao aproveitar a velocidade e eficiência da IA, os traders podem aprimorar seus processos de tomada de decisão e potencialmente aumentar a lucratividade, minimizando vieses emocionais.