投資中的人工智慧是什麼?

投資中的人工智慧(AI)指的是使用先進的算法和機器學習模型來分析財務數據、識別模式並做出明智的投資決策。AI 技術通過提供洞察、評估風險和自動化投資組合管理來賦能投資者。這些工具可以快速處理大量數據,從而實現幾乎即時的市場預測和戰略決策。

AI 在投資中的主要應用

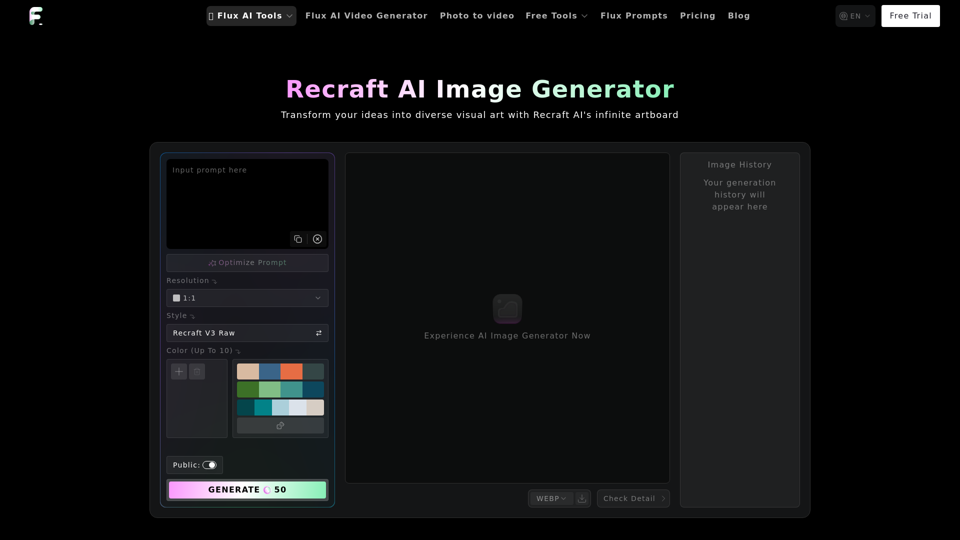

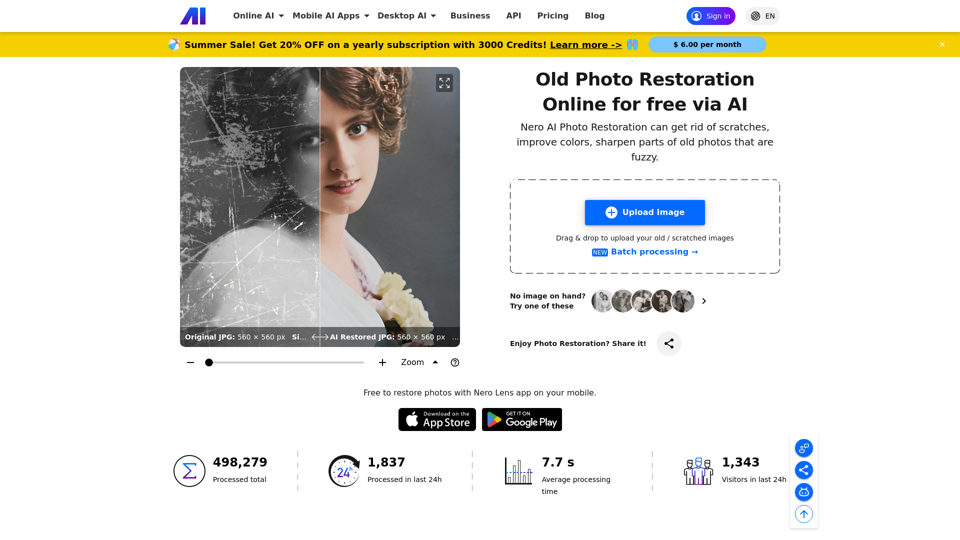

- 數據分析: AI 處理大型數據集,包括市場趨勢、財務報告和新聞,以發掘可行的見解。

- 情感分析: AI 評估來自社交媒體和新聞的投資者情緒,以預測市場走勢。

- 算法交易: 基於預定條件的自動交易,提高速度和效率。

- 風險管理: AI 識別潛在風險和機會,幫助投資者主動調整投資組合。

- 投資組合管理: AI 協助資產配置、多元化和再平衡,以優化回報。

使用 AI 投資的好處

AI 在投資領域提供了眾多優勢,增強了策略和執行力。

增強的決策制定

- 速度和效率: AI 快速處理和分析數據,允許更快的決策制定。

- 客觀分析: 減少情感偏見,導致更理性的投資選擇。

- 模式識別: 識別人類分析師可能無法察覺的趨勢和機會。

風險管理

- 實時洞察: 提供有關市場條件和潛在風險的最新信息。

- 自動調整: AI 可以自動重新平衡投資組合以維持期望的風險水平。

成本效益

- 降低運營成本: 自動化傳統上需要人工介入的任務,降低成本。

- 提高回報: 通過最小化錯誤和優化策略,AI 可以增強投資組合表現。

如何在投資策略中使用 AI

將 AI 納入您的投資策略涉及多個步驟,以確保有效利用。

步驟 1:定義財務目標

了解您的財務目標,以使 AI 工具與您的投資策略保持一致。

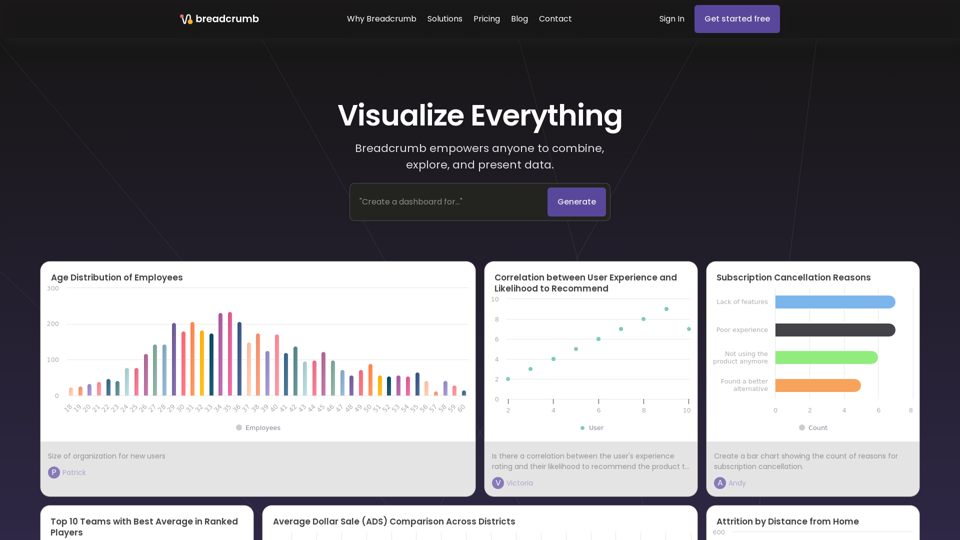

步驟 2:選擇 AI 工具

選擇適合您需求的 AI 工具,無論是用於數據分析、交易還是投資組合管理。考慮工具的準確性、成本和功能等因素。

步驟 3:從小額投資開始

從您的投資組合中拿出一小部分資金來測試 AI 工具並了解其能力。

步驟 4:監控表現

持續評估 AI 工具的表現與基準的對比,以確保與您的投資目標保持一致。

步驟 5:調整策略

準備根據 AI 洞察修改您的策略,同時保持人類監督以獲得最佳結果。

結論

人工智慧正在通過提供強大的數據分析、風險管理和投資組合優化工具來革新投資行業。雖然 AI 增強了決策制定和效率,但將 AI 洞察與人類判斷相結合對於達到最佳投資結果至關重要。隨著 AI 技術的不斷發展,保持信息靈通和適應能力將是充分利用其在金融市場中潛力的關鍵。